Students, here are the answers for the book back exercises in Chapter 3 Accounts of Partnership Firms –Fundamentals. If you have any doubts, please reach out to us in the comments section.

Click here if you want to revise:

Important Formulas, Accounts Formats and Notes for Chapter 3

I Multiple choice questions

Choose the correct answer:

| 1. In the absence of a partnership deed, profits of the firm will be shared by the partners in | |

| (a) Equal ratio | (b) Capital ratio |

| (c) Both (a) and (b) | (d) None of these |

| 2. In the absence of an agreement among the partners, interest on capital is | |

| (a) Not allowed | (b) Allowed at bank rate |

| (c) Allowed @ 5% per annum | (d) Allowed @ 6% per annum |

| 3. As per the Indian Partnership Act, 1932, the rate of interest allowed on loans advanced by partners is | |

| (a) 8% per annum | (b) 12% per annum |

| (c) 5% per annum | (d) 6% per annum |

| 4. Which of the following is shown in Profit and loss appropriation account? | |

| (a) Office expenses | (b) Salary of staff |

| (c) Partners’ salary | (d) Interest on bank loan |

| 5. When fixed capital method is adopted by a partnership firm, which of the following items will appear in capital account? | |

| (a) Additional capital introduced | (b) Interest on capital |

| (c) Interest on drawings | (d) Share of profit |

| 6. When a partner withdraws regularly a fixed sum of money at the middle of every month, period for which interest is to be calculated on the drawings on an average is | |

| (a) 5.5 months | (b) 6 months |

| (c) 12 months | (d) 6.5 months |

| 7. Which of the following is the incorrect pair? | |

| (a) Interest on drawings – Debited to capital account | (b) Interest on capital – Credited to capital account |

| (c) Interest on loan – Debited to capital account | (d) Share of profit – Credited to capital account |

| 8. In the absence of an agreement, partners are entitled to | |

| (a) Salary | (b) Commission |

| (c) Interest on loan | (d) Interest on capital |

| 9. Pick the odd one out | |

| (a) Partners share profits and losses equally | (b) Interest on partners’ capital is allowed at 7% per annum |

| (c) No salary or remuneration is allowed to partners | (d) Interest on loan from partners is allowed at 6% per annum. |

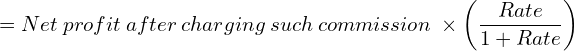

| 10. Profit after interest on drawings, interest on capital and remuneration is ` 10,500. Geetha, a partner, is entitled to receive commission @ 5% on profits after charging such commission. Find out commission. | |

| (a) Rs. 50 | (b) Rs. 150 |

| (c) Rs. 550 | (d) Rs. 500 |

II Very short answer questions

1. Define partnership.

Answer: According to Section 4 of the Indian Partnership Act, 1932, partnership is defined as, “the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all”.

2. What is a partnership deed?

Answer: Partnership deed is a document in writing that contains the terms of the agreement among the partners. It is not compulsory for a partnership to have a partnership deed as per the Indian Partnership Act, 1932. But, it is desirable to have a partnership deed as it serves as an evidence of the terms of the agreement among the partners.

3. What is meant by fixed capital method?

Answer: Fixed capital method is a system by which capital accounts of partners of a firm may be maintained. In this method, the capital of the partners is not altered and it remains fixed.

Two accounts are maintained for each partner namely (a) Capital account and (b) Current account. The transactions relating to initial capital introduced, additional capital introduced and capital permanently withdrawn are entered in the capital account. All other transactions are recorded in the current account.

4. What is the journal entry to be passed for providing interest on capital to a partner?

Answer:

| Date | Particulars | LF | Debit | Credit |

| Interest on capital A/c Dr. | xxx | |||

| To Partner’s capital / current A/c | xxx | |||

| (For providing interest on capital) | ||||

| Profit and loss appropriation A/c Dr. | xxx | |||

| To Interest on capital A/c | xxx | |||

| (For closing interest on capital account) |

5. Why is Profit and loss appropriation account prepared?

Answer: The profit and loss appropriation account is an extension of profit and loss account prepared for the purpose of adjusting the transactions relating to amounts due to and amounts due from partners.

III Short answer questions

1. State the features of partnership.

Answer: Following are the essential features of partnership:

1. Partnership is an association of two or more persons. The maximum number of partners is limited to 50.

2. There should be an agreement among the persons to share the profit or loss of the business. The agreement may be oral or written or implied.

3. The agreement must be to carry on a business and to share the profits of the business.

4. The business may be carried on by all the partners or any of them acting for all.

2. State any six contents of a partnership deed.

Answer: Generally, partnership deed contains the following:

1. Name of the firm and nature and place of business

2. Date of commencement and duration of business

3. Names and addresses of all partners

4. Capital contributed by each partner

5. Profit sharing ratio

6. Amount of drawings allowed to each partner

3. State the differences between fixed capital method and fluctuating capital method.

Answer:

| Feature | Fixed capital method | Fluctuating capital method |

| 1. Number of accounts | Two accounts are maintained for each partner, that is, capital account and current account. | Only one account, that is, capital account is maintained for each partner. |

| 2. Change in capital | The amount of capital normally remains unchanged except when additional capital is introduced or capital is withdrawn permanently. | The amount of capital changes from period to period. |

| 3. Closing balance | Capital account always shows a credit balance. But, current account may show either debit or credit balance. | Capital account generally shows credit balance. It may also show a debit balance. |

| 4. Adjustments | All adjustments relating to interest on capital, interest on drawings, salary or commission, share of profit or loss are done in current account. | All adjustments relating to interest on capital, interest on drawings, salary or commission, share of profit or loss are done in the capital account. |

4. Write a brief note on the applications of the provisions of the Indian Partnership Act, 1932 in the absence of partnership deed.

Answer: If there is no partnership deed or when there is no express statement in the partnership deed, then the following provisions of the Act will apply:

(i) Remuneration to partners

No salary or remuneration is allowed to any partner. [Section 13(a)]

(ii) Profit sharing ratio

Profits and losses are to be shared by the partners equally. [Section 13(b)]

(iii) Interest on capital

No interest is allowed on the capital. Where a partner is entitled to interest on capital contributed as per partnership deed, such interest on capital will be payable only out of profits. [Section 13(c)]

(iv) Interest on loans advanced by partners to the firm

Interest on loan is to be allowed at the rate of 6 per cent per annum. [Section 13(d)]

(v) Interest on drawings

No interest is charged on the drawings of the partners.

5. Jayaraman is a partner who withdrew Rs.10,000 regularly in the middle of every month. Interest is charged on the drawings at 6% per annum. Calculate interest on drawings for the year ended 31st December, 2018.

Answer: Interest on capital = Amount of capital x Rate of interest per annum x Period of interest

![]()

IV Exercises

1. Akash, Bala, Chandru and Daniel are partners in a firm. There is no partnership deed. How will you deal with the following?

(i) Akash has contributed maximum capital. He demands interest on capital at 10% per annum.

(ii) Bala has withdrawn Rs.3,000 per month. Other partners ask Bala to pay interest on drawings @ 8% per annum to the firm. But, Bala did not agree to it.

(iii) Akash demands the profit to be shared in the capital ratio. But, others do not agree.

(iv) Daniel demands salary at the rate of Rs.10,000 per month as he spends full time for the business.

(v) Loan advanced by Chandru to the firm is Rs.50,000. He demands interest on loan @ 12% per annum.

Answer:

(i) No interest on capital is payable to any partner.

(ii) No interest is chargeable on drawings made by the partner.

(iii) Profits should be distributed equally.

(iv) No remuneration is payable to any partner.

(v) Interest on the loan is payable at 6% per annum.

2. From the following information, prepare capital accounts of partners Rooban and Deri, when their capitals are fixed.

| Particulars | Rooban (Rs) | Deri (Rs) |

|---|---|---|

| Capital on 1st April, 2018 | 70,000 | 50,000 |

| Current account on 1st April, 2018 (Cr.) | 25,000 | 15,000 |

| Additional capital introduced | 18,000 | 16,000 |

| Drawings during 2018 – 2019 | 10,000 | 6,000 |

| Interest on drawings | 500 | 300 |

| Share of profit for 2018 – 2019 | 35,000 | 25,800 |

| Interest on capital | 3,500 | 2,500 |

| Salary | Nil | 18,000 |

| Commission | 12,000 | Nil |

Answer:

| Fixed Capital Account | |||||

|---|---|---|---|---|---|

| Particulars | Rooban | Deri | Particulars | Rooban | Deri |

| To balance c/d | 88.000 | 66,000 | By balance b/d | 70,000 | 50,000 |

| By cash/bank | 18,000 | 16,000 | |||

| Total | 88.000 | 66,000 | Total | 88.000 | 66,000 |

| By balance b/d | 88.000 | 66,000 | |||

| Current Account | |||||

|---|---|---|---|---|---|

| Particulars | Rooban | Deri | Particulars | Rooban | Deri |

| To drawing | 10,000 | 6,000 | By balance b/d | 25,000 | 15,000 |

| To interest on drawing | 500 | 300 | By share of profit | 35,000 | 25,800 |

| To balance c/d | 65,000 | 55,000 | By interest on capital | 3500 | 2500 |

| By salary | 18,000 | ||||

| By commission | 12,000 | ||||

| Total | 75,500 | 61,300 | Total | 75,500 | 61,300 |

| By balance b/d | 65,000 | 55,000 | |||

3. Arun and Selvam are partners who maintain their capital accounts under fixed capital method. From the following particulars, prepare capital accounts of partners.

| Particulars | Arun (Rs.) | Selvam (Rs.) |

|---|---|---|

| Capital on 1st January, 2018 | 2,20,000 | 1,50,000 |

| Current account on 1st January, 2018 | 4,250(Dr.) | 10,000(Cr.) |

| Additional capital introduced during the year | Nil | 70,000 |

| Withdrew for personal use | 10,000 | 20,000 |

| Interest on drawings | 750 | 600 |

| Share of profit for 2018 | 22,000 | 15,000 |

| Interest on capital | 1,100 | 750 |

| Commission | 6,900 | Nil |

| Salary | Nil | 6,850 |

| Capital Account | |||||

|---|---|---|---|---|---|

| Particulars | Arun | Selvam | Particulars | Arun | Selvam |

| To balance c/d | 2,20,000 | 2,20,000 | By balance c/d | 2,20,000 | 1,50,000 |

| By bank | 70,000 | ||||

| Total | 2,20,000 | 2,20,000 | Total | 2,20,000 | 2,20,000 |

| By balance c/d | 2,20,000 | 2,20,000 | |||

| Current Account | |||||

|---|---|---|---|---|---|

| Particulars | Arun | Selvam | Particulars | Arun | Selvam |

| To balance c/d | 4250 | By balance b/d | 10,000 | ||

| To drawing | 10,000 | 20,000 | By share of profit | 22,000 | 15,000 |

| To interest on drawings | 750 | 600 | By interest on capital | 1100 | 750 |

| To balance c/d | 15,000 | 12,000 | By salary | 6850 | |

| By commission | 6900 | ||||

| Total | 30,000 | 32,600 | Total | 30,000 | 32,600 |

| By balance b/d | 15,000 | 12,000 | |||

4. From the following information, prepare capital accounts of partners Padmini and Padma, when their capitals are fluctuating.

| Particulars | Padmini (Rs.) | Padma (Rs.) |

|---|---|---|

| Capital on 1st January 2018 (Cr. balance) | 5,00,000 | 4,00,000 |

| Drawings during 2018 | 70,000 | 40,000 |

| Interest on drawings | 2,000 | 1,000 |

| Share of profit for 2018 | 52,000 | 40,000 |

| Interest on capital | 30,000 | 24,000 |

| Salary | 45,000 | Nil |

| Commission | Nil | 21,000 |

| Capital Account | |||||

|---|---|---|---|---|---|

| Particulars | Padmini | Padma | Particulars | Padmini | Padma |

| To drawing | 70,000 | 40,000 | By balance b/d | 500,000 | 400,000 |

| To interest on drawings | 2000 | 1000 | By share of profit | 52,000 | 40,000 |

| To balance c/d | 5,55,000 | 4,44,000 | By interest on capital | 30,000 | 24,000 |

| By salary | 45,000 | ||||

| By commission | 21,000 | ||||

| Total | 627,000 | 485,000 | Total | 627,000 | 485,000 |

| By balance b/d | 5,55,000 | 4,44,000 | |||

5. Mannan and Ramesh share profits and losses in the ratio of 3:2 and their capital on 1st April, 2018 was Mannan Rs.1,50,000 and Ramesh Rs.1,00,000 respectively and their current accounts show a credit balance of Rs.25,000 and Rs.20,000 respectively. Calculate interest on capital at 6% p.a. for the year ending 31st March, 2019 and show the journal entries.

Answer: Interest on capital = Amount of capital x Rate of interest per annum x Period of interest

![]()

![]()

| Date | Particulars | LF | Debit | Credit |

|---|---|---|---|---|

| 2019 | Interest on capital A/c Dr. | 15,000 | ||

| 31st March | To Mannan's capital a/c | 9000 | ||

| To Ramesh's capital a/c | 6000 | |||

| (For providing interest on capital) | ||||

| 31st March | Profit and loss appropriation A/c Dr. | 15,000 | ||

| To Interest on capital A/c | 15,000 | |||

| (For closing interest on capital account) |

6. Prakash and Supria were partners who share profits and losses in the ratio of 5:3. Balance in their capital account on 1st April, 2018 was Prakash Rs.3,00,000 and Supria Rs.2,00,000. On 1st July, 2018 Prakash introduced additional capital of Rs.60,000. Supria introduced additional capital of Rs.30,000 during the year. Calculate interest on capital at 6% p.a. for the year ending 31st March, 2019 and show the journal entries.

![]()

![]()

![]()

![]()

| Date | Particulars | LF | Debit | Credit |

|---|---|---|---|---|

| 2019 | Interest on capital A/c Dr. | 33.600 | ||

| 31st March | To Prakash capital a/c | 20,700 | ||

| To Supriya capital a/c | 12,900 | |||

| (For providing interest on capital) | ||||

| 31st March | Profit and loss appropriation A/c Dr. | 33.600 | ||

| To Interest on capital A/c | 33.600 | |||

| (For closing interest on capital account) |

7. The capital account of Begum and Fatima on 1st January, 2018 showed a balance of Rs.50,000 and Rs.40,000 respectively. On 1st October, 2018, Begum introduced an additional capital of Rs.10,000 and on 1st May, 2018 Fatima introduced an additional capital of Rs.9,000. Calculate interest on capital at 4% p.a. for the year ending 31st December, 2018.

![]()

![]()

![]()

![]()

Begum :Total Interest on capital =Rs.2100

Fatima: Total Interest on capital =Rs.1840

8. From the following balance sheets of Subha and Sudha who share profits and losses in 2:3, calculate interest on capital at 5% p.a. for the year ending 31st December, 2018.

| Balance sheet as on 31st December, 2018 | ||||

|---|---|---|---|---|

| Liabilities | Rs. | Rs. | Assets | Rs. |

| Capital accounts: | Fixed assets | 70,000 | ||

| Subha | 40,000 | Current assets | 50,000 | |

| Sudha | 60,000 | 1,00,000 | ||

| Current liabilities | 20,000 | |||

| Total | 1,20,000 | Total | 1,20,000 | |

Anwser:

| Calculation of Opening Capital | ||

|---|---|---|

| Particulars | Sudha | Subha |

| Capital as on 31-12-18 | 40,000 | 60,000 |

| Add: Drawings | 8,000 | 10,000 |

| Less: Profit | 48,000 | 70,000 |

| 12,000 | 18,000 | |

| Capital as on 01-01-18 | 36,000 | 52,000 |

![]()

![]()

9. From the following balance sheets of Rajan and Devan who share profits and losses 2:1, calculate interest on capital at 6% p.a. for the year ending 31st December, 2018.

| Balance sheet as on 31st December, 2018 | ||||

|---|---|---|---|---|

| Liabilities | Rs. | Rs. | Assets | Rs. |

| Capital accounts: | Sundry assets | 2,20,000 | ||

| Rajan | 100,000 | |||

| Devan | 80,000 | 1,80,000 | ||

| Current liabilities | 40,000 | |||

| Total | 2,20,000 | Total | 2,20,000 | |

Answer:

| Calculation of Opening Capital | ||

|---|---|---|

| Particulars | Rajan | Devan |

| Capital as on 31-12-18 | 100,000 | 80,000 |

| Add: Drawings | 20,000 | 10,000 |

| 120,000 | 90,000 | |

| Less: Additional capital | 40,000 | 30,000 |

| 80,000 | 60,000 | |

| Less: Profit | 20,000 | 10,000 |

| Capital as on 01-01-18 | 60,000 | 50,000 |

![]()

![]()

Rajan: Total Interest on capital =Rs.5400

![]()

![]()

Devan: Total Interest on capital =Rs.3600

10. Ahamad and Basheer contribute Rs. 60,000 and Rs. 40,000 respectively as capital. Their respective share of profit is 2:1 and the profit before interest on capital for the year is Rs. 5,000. Compute the amount of interest on capital in each of the following situations:

(i) if the partnership deed is silent as to the interest on capital

(ii) if interest on capital @ 4% is allowed as per the partnership deed

(iii) if the partnership deed allows interest on capital @ 6% per annum.

Answer: Interest on capital @4%

![]()

![]()

Interest on capital @6%

![]()

![]()

(i) If the partnership deed is silent as to the interest on capital – No Interest on capital is allowed.

(ii) if interest on capital @ 4% is allowed as per the partnership deed – There is sufficient profit. Therefore, interest on capital will be allowed to Ahamad. ₹ 2,400; Basheer. ₹ 1,600

(iii) if the partnership deed allows interest on capital @ 6% per annum – Since the profit is insufficient, interest on capital will not be provided. The profit of ₹ 5,000 will be distributed to the partners in their capital ratio of 3:2.

11. Mani is a partner, who withdrew Rs. 30,000 on 1st September, 2018. Interest on drawings is charged at 6% per annum. Calculate interest on drawings on 31st December, 2018 and show the journal entries by assuming that fluctuating capital method is followed.

Answer: Interest on drawings= Amount withdrawn x Rate of interest per annum x Period of interest

![]()

| Date | Particulars | LF | Debit | Credit |

|---|---|---|---|---|

| 2018 | Mani capital A/c Dr. | 600 | ||

| 31st December | To interest on drawings a/c | 600 | ||

| (Interest on drawings charged) | ||||

| 31st March | Interest on drawings a/c Dr. | 600 | ||

| To Profit and Loss Appropriation A/c | 600 | |||

| (For closing interest on drawings account) |

12. Santhosh is a partner in a partnership firm. As per the partnership deed, interest on drawings is charged at 6% per annum. During the year ended 31st December, 2018 he withdrew as follows:

| Date | Rs. |

|---|---|

| February 1 | 2,000 |

| May 1 | 10,000 |

| July 1 | 4,000 |

| October 1 | 6,000 |

Calculate the amount of interest on drawings.

Answer: Interest on drawings= Amount withdrawn x Rate of interest per annum x Period of interest

| Date of Withdrawal | Rs. |

|---|---|

| February 1 | |

| May 1 | |

| July 1 | |

| October 1 |

Total interest on drawings = Rs. 110+ Rs.400 + Rs.120 + Rs. 90 = Rs.720

13. Kumar is a partner in a partnership firm. As per the partnership deed, interest on drawings is charged at 6% per annum. During the year ended 31st December, 2018 he withdrew as follows:

| Date | Rs. |

|---|---|

| March 1 | 4,000 |

| June 1 | 4,000 |

| September 1 | 4,000 |

| December 1 | 4,000 |

Calculate the amount of interest on drawings.

Answer: Interest on drawings= Amount withdrawn x Rate of interest per annum x Period of interest.

| Date of Withdrawal | Rs. |

|---|---|

| March 1 | |

| June 1 | |

| September 1 | |

| December 1 |

Total interest on drawings = Rs. 200+ Rs.140+ Rs.80 + Rs. 20 = Rs.440.

14. Mathew is a partner who withdrew Rs. 20,000 during the year 2018. Interest on drawings is charged at 10% per annum. Calculate interest on drawings on 31st December 2018.

Answer: Interest on drawings= Amount withdrawn x Rate of interest per annum x Period of interest

![]()

15. Santhosh is a partner in a partnership firm. As per the partnership deed, interest on drawings is charged at 6% per annum. During the year ended 31st December, 2018 he withdrew as follows:

| Date | Rs. |

|---|---|

| February 1 | 2,000 |

| May 1 | 10,000 |

| July 1 | 4,000 |

| October 1 | 6,000 |

Calculate the amount of interest on drawings by using product method.

Answer:

| Date | Amt Withdrawn | Period | Product (BXC) |

|---|---|---|---|

| 1-2-2018 | 2000 | 11 | 22,000 |

| 1-5-2018 | 10,000 | 8 | 80,000 |

| 1-7-2018 | 4,000 | 6 | 24,000 |

| 1-10-2018 | 6,000 | 3 | 18,000 |

| Total | 144,000 |

![]()

16. Kavitha is a partner in a firm. She withdraws Rs. 2,500 p.m. regularly. Interest on drawings is charged @ 4% p.a. Calculate the interest on drawings using average period, if she draws

(i) at the beginning of every month

(ii) in the middle of every month

(iii) at the end of every month

Answer: Interest on drawings =

![]()

(i) at the beginning of every month:

![]()

(ii) in the middle of every month

![]()

(iii) at the end of every month

![]()

17. Kevin and Francis are partners. Kevin draws Rs. 5,000 at the end of each quarter. Interest on drawings is chargeable at 6% p.a. Calculate interest on drawings for the year ending 31st March 2019 using average period.

Answer: Interest on drawings for Kevin:

Amount = Rs.5000 for every quarter= 5000 x 4=20,000

![]()

![]()

18. Ram and Shyam were partners. Ram withdrew Rs. 18,000 at the beginning of each half year. Interest on drawings is chargeable @ 10% p.a. Calculate interest on the drawings for the year ending 31st December 2018 using average period.

Answer: Interest on drawings for Ram:

Amount = Rs. 18,000 at beginning of every half year = 18,000 x 2=36,000

![]()

![]()

19. Janani, Kamali and Lakshmi are partners in a firm sharing profits and losses equally. As per the terms of the partnership deed, Kamali is allowed a monthly salary of Rs. 10,000 and Lakshmi is allowed a commission of Rs. 40,000 per annum for their contribution to the business of the firm. You are required to pass the necessary journal entry. Assume that their capitals are fluctuating.

Answer:

| Particulars | LF | Debit | Credit |

|---|---|---|---|

| Kamali's Salary a/c | 120,000 | ||

| To Kamali Capital a/c | 120,000 | ||

| (Kamali's salary transferred to capital a/c) | |||

| Lakshmi's commission a/c | 40,000 | ||

| To Lakshmi Capital a/c | 40,000 | ||

| (Lakshmi's commission transferred to capital a/c) | |||

| P&L Appropriation a/c | 160,000 | ||

| To Kamali's Salary a/c | 120,000 | ||

| To Lakshmi's commission a/c | 40,000 | ||

| (salary and commission transferred to P&L Appropriation a/c) |

20. Sibi and Manoj are partners in a firm. Sibi is to get a commission of 20% of net profit before charging any commission. Manoj is to get a commission of 20% on net profit aftercharging all commission. Net profit for the year ended 31st December 2018 before charging any commission was Rs. 60,000. Find the commission of Sibi and Manoj. Also show the distribution of profit.

Answer: Sibi’s commission: Net profit before charging such commission x Profit percentage

![]()

Manoj’s commission:

![]()

| Distribution of profit | ||

|---|---|---|

| Net profit | 60,000 | |

| Less Sibi's commission | 12,000 | |

| Less Manoj's commission | 8,000 | 20,000 |

| 40,000 |

![]()

![]()

21. Anand and Narayanan are partners in a firm sharing profits and losses in the ratio of 5:3. On 1st January 2018, their capitals were Rs. 50,000 and Rs. 30,000 respectively. The partnership deed specifies the following:

(a) Interest on capital is to be allowed at 6% per annum.

(b) Interest on drawings charged to Anand and Narayanan are Rs. 1,000 and Rs. 800 respectively.

(c) The net profit of the firm before considering interest on capital and interest on drawings amounted to Rs. 35,000.

Give necessary journal entries and prepare profit and loss appropriation account as on 31st December 2018. Assume that the capitals are fluctuating.

| Date | Particulars | LF | Debit | Credit |

|---|---|---|---|---|

| 31-12-2018 | Interest on capital a/c Dr | 4800 | ||

| To Anand's capital a/c | 3000 | |||

| To Narayanan's capital a/c | 1800 | |||

| (interest on capital provided) | ||||

| 31-12-2018 | Anand's capital a/c Dr. | 1000 | ||

| Narayanan's capital a/c Dr. | 800 | |||

| To interest on drawings | 1800 | |||

| 31-12-2018 | P&L Appropriation a/c Dr | 4800 | ||

| To interest on capital a/c | 4800 | |||

| (interest on capital closed) | ||||

| 31-12-2018 | Interest on drawings a/c Dr. | 1800 | ||

| To P&L Appropriation a/c | 1800 | |||

| (interest on drawings closed) | ||||

| 31-12-2018 | P&L Appropriation a/c Dr | 32,000 | ||

| To Anand's capital a/c | 20,000 | |||

| To Narayanan's capital a/c | 12,000 | |||

| (share of profit distributed) |

| P&L Appropriation a/c | |||||

|---|---|---|---|---|---|

| Particulars | Rs. | Particulars | Rs. | ||

| To interest on capital | By net profit b/d | 35,000 | |||

| Anand | 3000 | By interest on drawings | |||

| Narayanan | 1800 | 4800 | Anand | 1000 | |

| To profit transferred to capital a/c | Narayanan | 800 | 1800 | ||

| Anand | 20,000 | ||||

| Narayanan | 12,000 | 32,000 | |||

| Total | 36,800 | Total | 36,800 | ||

22. Dinesh and Sugumar entered into a partnership agreement on 1st January 2018, Dinesh contributing Rs. 1,50,000 and Sugumar Rs. 1,20,000 as capital. The agreement provided that:

(a) Profits and losses to be shared in the ratio 2:1 as between Dinesh and Sugumar.

(b) Partners to be entitled to interest on capital @ 4% p.a.

(c) Interest on drawings to be charged Dinesh: Rs. 3,600 and Sugumar: Rs. 2,200

(d) Dinesh to receive a salary of Rs. 60,000 for the year, and

(e) Sugumar to receive a commission of Rs. 80,000

During the year ended on 31st December 2018, the firm made a profit of Rs. 2,20,000 before adjustment of interest, salary and commission.

Prepare the Profit and loss appropriation account.

Answer:

| P & L Appropriation a/c | |||||

|---|---|---|---|---|---|

| Particulars | Rs. | Rs. | Particulars | Rs. | |

| To interest on capital a/c | By net profit b/d | 2,20,000 | |||

| Dinesh | 6000 | By interest on drawing | |||

| Sugumar | 4800 | 10,800 | Dinesh | 3600 | |

| To salary a/c - Dinesh | 60,000 | Sugumar | 2200 | 5800 | |

| To commission a/c - Sugumar | 80,000 | ||||

| To profit transferred to capital a/c | |||||

| Dinesh | 50,000 | ||||

| Sugumar | 25,000 | 75,000 | |||

| Total | 2,25,800 | Total | 2,25,800 | ||

Calculation of interest on capital:

![]()

![]()

23. Antony and Ranjith started a business on 1st April 2018 with capitals of Rs. 4,00,000 and Rs. 3,00,000 respectively. According to the Partnership Deed, Antony is to get salary of Rs. 90,000 per annum, Ranjith is to get 25% commission on profit after allowing salary to Antony and interest on capital @ 5% p.a. but after charging such commission. Profit-sharing ratio between the two partners is 1:1. During the year, the firm earned a profit of Rs. 3,65,000. Prepare profit and loss appropriation account. The firm closes its accounts on 31st March every year.

Answer:

| P & L Appropriation a/c | ||||

|---|---|---|---|---|

| Particulars | Rs. | Rs. | Particulars | Rs. |

| To interest on capital a/c | By net profit b/d | 365,000 | ||

| Antony | 20,000 | |||

| Ranjith | 15,000 | 35,000 | ||

| To salary a/c - Antony | 90,000 | |||

| To commission a/c - Ranjith | 48,000 | |||

| To profit transferred to capital a/c | ||||

| Antony | 96,000 | |||

| Ranjith | 96,000 | 192,000 | ||

| Total | 365,000 | Total | 365,000 | |

Calculation of profit before charging such commission:

| Net profit | 365,000 | |

| Less: | ||

| Interest on capital | ||

| Antony | 20,000 | |

| Ranjith | 15,000 | 35,000 |

| Salary | 90,000 | |

| Profit before commission | 240,000 |

![]()

![]()

If you have any doubts in this exercise, please let us know in the comments section.

Leave a Reply