Prepare for your CMA Foundation Paper 1 Business Laws and Business Communication. using our CMA Foundation Study Materials. Here is Lesson 1.3: Legal Methods and Court System in India.

In Lesson 1.3 of the CMA Foundation Paper 1, you will learn about the judiciary, tribunals, ADR, and the regulatory framework governing the Indian courts.

Legal Methods and Court System in India

The Judiciary of India is one of the most vital organs of the State. It acts as:

- The watchdog of democracy,

- The guardian of the Constitution, and

- The protector of rightsof individuals and institutions.

India follows a single integrated judicial system with a pyramidal structure:

- Supreme Court of India(Apex Court)

- High Courts(in each State/Union Territory)

- Subordinate Courts(district and local levels)

The Constitution of India (1950) lays down the framework for this system:

| Court | Framework |

| Supreme Court | Part V, Chapter IV (Articles 124–147) |

| High Courts | Part VI, Chapter V (Articles 214–231) |

| Subordinate Courts | Part VI, Chapter VI (Articles 233–237) |

Supreme Court of India

The Supreme Courtis the highest judicial authority in India. It comprises the Chief Justice of India (CJI)and other judges (appointed by the President).

Powers and Jurisdiction of the Supreme Court

1. Original Jurisdiction (Art. 131)→ Disputes between:

- Union and State(s)

- Two or more States

- Union + State(s) on one side vs. other State(s)

2. Writ Jurisdiction (Art. 32)

Citizens can approach directly for enforcement of Fundamental Rights.

3. Appellate Jurisdiction

Hears appeals against judgments of High Courts (civil, criminal, constitutional).

4. Advisory Jurisdiction (Art. 143)

The President may seek advice on questions of public importance.

5. Contempt of Court (Art. 129)

Supreme Court is a Court of Record, can punish for contempt.

6. Review Jurisdiction (Art. 137)

Can review its own judgments.

Note: At independence, the Supreme Court had 8 judges (1 CJI + 7). Today, it has 34 judges (33 + 1 CJI).

High Courts of India

High Courts are the highest judicial bodies at the State level.

Powers of High Courts

1. Original Jurisdiction: Can decide disputes related to:

Fundamental rights enforcement, election disputes, revenue cases.

2. Writ Jurisdiction (Art. 226)

Any person has the right to approach the Court against violation of his fundamental rights and legal rights under Article 226. Broader than Supreme Court’s writ powers.

3. Appellate Jurisdiction

Appeals from subordinate courts (civil & criminal).

4. Power of Superintendence (Art. 227 & 228)

Every High Court has the authority to supervise all courts and tribunals that fall within its region.

This is not about deciding the actual cases but making sure that the lower courts and tribunals:

- work within their powers,

- follow proper procedures,

- and deliver justice fairly.

So, the High Court acts like a guardian to ensure that the entire judicial system under it runs properly.

Power of Transfer (Article 228)

This ensures that important legal questions are settled by a higher authority, maintaining consistency and correctness in the interpretation of law.

Sometimes, a case in a lower court raises a big constitutional or legal question (called a “substantial question of law”).

In such cases, the High Court can take that case away from the lower court and deal with it directly.

This ensures that important legal questions are settled by a higher authority, maintaining consistency and correctness in the interpretation of law.

In short:

- Article 227 = Supervision (keeping an eye on lower courts and tribunals).

- Article 228 = Transfer of important cases (bringing up cases involving serious legal questions).

5. Punishment for Contempt

- The Constitution declares the High Court as a Court of Record (just like the Supreme Court).

- Being a Court of Record means two things:

- Its judgments and decisions are recorded and have permanent value.

- These judgments act as precedents (guidance) for future cases.

- Along with this status, the High Court has the power to punish anyone for contempt of court.

What is Contempt of Court?

Contempt means disrespecting or disobeying the court’s authority. It can be of two types:

- Civil Contempt – When someone disobeys a court order (for example, ignoring an injunction or refusing to follow a judgment).

- Criminal Contempt – When someone acts in a way that lowers the dignity of the court, like insulting judges, interfering in court proceedings, or publishing statements that mislead or prejudice a case.

This power is important because it helps the High Court maintain its authority, ensure obedience to its orders, and protect the dignity of the judiciary.

Lower/Subordinate Courts

Chapter VI of Part VI of the Indian Constitution deals with subordinate courts. It functions below the High Courts in the judicial hierarchy. These courts are created and supervised by the High Courts, keeping in mind local needs and administrative factors.

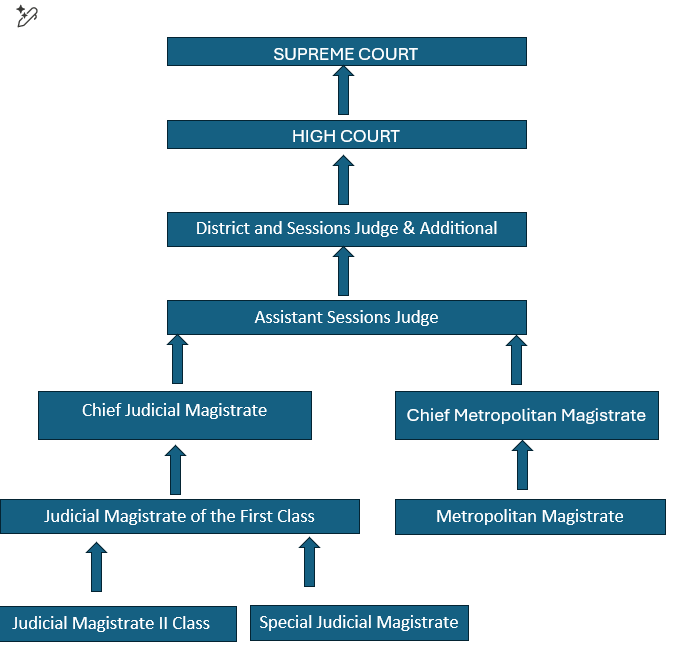

Criminal Court Structure

Section 6 of the Criminal Procedure Code 1973 prescribes 4 classes of criminal courts:

1. Court of Session→ It is headed by a Sessions Judge (appointed by High Court). Handles serious criminal matters.

2. Metropolitan Magistrate Courts→ It is for metropolitan cities (population >1 million). These Courts are subordinate to the Sessions Court. They cannot award death penalty, life imprisonment, or imprisonment for more than 7 years.

3. Chief Judicial Magistrate Courts (CJM)→ They supervise Judicial Magistrates of First Class & Second Class. These courts also cannot award death penalty, life imprisonment, or imprisonment for more than 7 years.

4. Executive Magistrates→ They maintain law and order (administrative powers, not judicial).

Hierarchy (Criminal Courts)

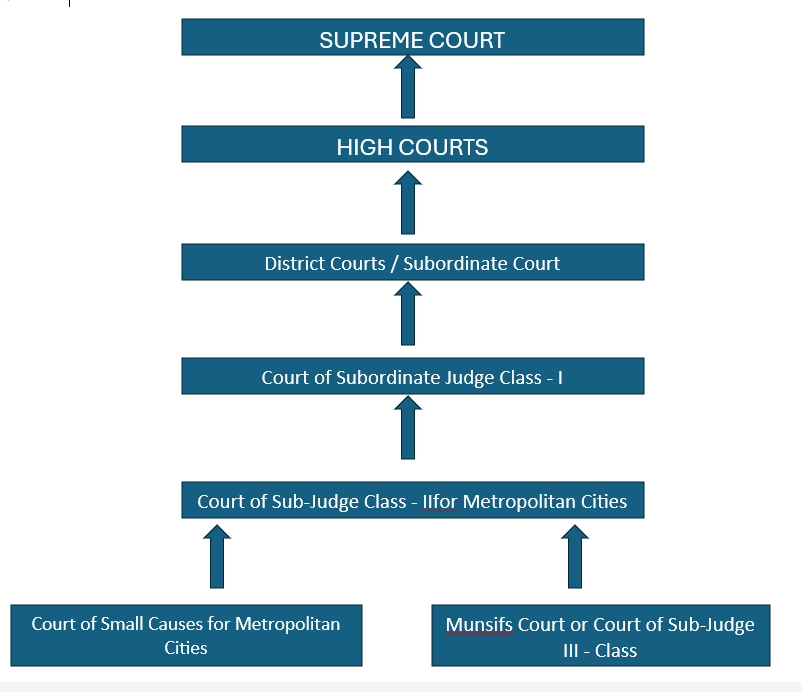

Civil Court Structure

The district court is the highest civil court in a district. It has judicial as well as administrative powers including the power of superintendence with both appellate and original jurisdiction. These judges are appointed by Governor in consultation with High Court (Art. 233).

The courts subordinate to the District Courts are:

- Sub-Judge Courts→ Handle higher-value civil cases below District Court level.

- Additional Sub-Judge→ Assists Sub-Judge.

- Munsif Courts→ Deal with smaller pecuniary jurisdiction cases.

- Court of Small Causes(in metros) → Handles minor disputes like tenancy, rent, etc.

Hierarchy of (Civil Courts)

The Tribunal System in India

Tribunals are special institutions set up to perform judicial or quasi-judicial functions. Their main purpose is twofold:

- To reduce the burden on regular courts by handling specific types of cases.

- To provide subject expertise in technical or specialized matters (for example, taxation, company law, service disputes, or environmental issues).

Unlike ordinary courts, tribunals are designed to deliver faster and more expert justice in their respective areas.

Independence of Tribunals

Tribunals are quasi-judicial bodies,. This means that they enjoy the same independence from the executive as the regular judiciary. To ensure this, certain factors become very important, such as:

- Mode of selection of members – how the chairpersons and members are appointed.

- Composition of tribunals – the balance between judicial members and technical experts.

- Terms and tenure of service – the security and length of service provided to members.

To protect the independence of tribunals from executive influence, the Supreme Court recommended that their administrative matters (such as finances, staffing, and management) should be handled by the Ministry of Law and Justice.

Structure of Indian Tribunal System

Composition of Tribunals:

Tribunals are unique because they consist of both Judicial Members and Technical Members.

| Judicial Members | Technical Members |

| Persons with a judicial background, such as High Court Judges or lawyers with the required years of experience who are eligible to be High Court Judges. | Experts from different fields, often drawn from government departments or specialized sectors. |

This mix of judicial and technical expertise is what sets tribunals apart from traditional courts.

Alternate Dispute Resolution (ADR)

Alternate Dispute Resolution (ADR) is a process used to resolve disputes between parties without involving traditional courts. It is applicable to various matters, such as civil, commercial, industrial, and family disputes, where parties struggle to negotiate and reach a settlement.

Modes of Alternate Dispute Resolution (ADR)

ADR provides methods to resolve disputes outside the traditional court system. This helps save time, reduce costs, and maintain relationships between parties. The important modes are:

1. Arbitration

- In arbitration, the dispute is referred to an arbitral tribunal (a neutral third party or panel).

- The tribunal gives a decision called an “award”, which is usually final and binding on both parties.

- Courts have very limited power to interfere, except for a few interim measures (like preserving property or evidence during the dispute).

Example: Business contract disputes are often settled by arbitration instead of going to court.

2. Conciliation

- Conciliation is a non-binding process where an impartial third party, called the conciliator, helps the parties reach a mutual agreement.

- The conciliator can make suggestions or recommendations, but the parties are free to accept or reject them.

- If both parties accept the final settlement document prepared by the conciliator, it becomes final and binding.

Example: Employment or family disputes are often resolved through conciliation.

3. Mediation

- Mediation is an informal process where an impartial third party, called the mediator, helps the disputing parties talk through their issues and find a mutually acceptable solution.

- Unlike an arbitrator, the mediator does not give a decision.

- Instead, the mediator guides communication and negotiation. The final decision rests entirely with the parties.

- This method is especially useful where preserving relationships (family, workplace, business) is important.

Example: Family disputes, landlord–tenant issues, or community conflicts are often resolved through mediation.

4. Lok Adalat

- A unique feature of the Indian legal system is the Lok Adalat or “People’s Court”. It is set up to provide quick and affordable justice through out-of-court settlements.

- The system was given statutory backing through the Legal Services Authorities Act, 1987.

- In a Lok Adalat, disputes are settled through negotiation and compromise in the presence of a judicial officer.

- The decision (award) of a Lok Adalat is:

- Final and binding on the parties, and

- Not appealable in any court of law.

This makes Lok Adalats an effective mechanism for reducing court pendency and ensuring speedy justice, especially for small and straightforward disputes.

Important Provisions Related to ADR

Section 89 of the Civil Procedure Code (CPC), 1908 provides the legal basis for ADR in India.

According to this section, if the court feels that there are chances of settling a dispute outside the courtroom, it can:

- Formulate the terms of a possible settlement, and

- Refer the case to one of the ADR mechanisms – Arbitration, Conciliation, Mediation, or Lok Adalat.

This provision encourages parties to resolve disputes amicably and speedily, reducing the burden on regular courts.

There are 2 Acts that deal with Alternative Dispute Resolution. They are:

- Arbitration and Conciliation Act, 1996; and

- The Legal Services Authority Act, 1987

Compulsory Mediation

Since Indian courts are burdened with a heavy backlog of cases, the legislature has made mediation a compulsory prerequisite in certain types of disputes before a case can be filed in court. Some of these statutes are:

| Statutes | Description |

| Industrial Disputes Act, 1947 | Section 4 of the Act assigns conciliators the responsibility to mediate and settle industrial disputes and prescribes the procedure to be followed. |

| Code of Civil Procedure, 1908 | It provides reference of all pending court cases to mediation. The amendment also prescribes mediation for all family and personal matters. |

| Companies Act, 2013 | Sec. 442 provides for referral of disputes to mediation by the National Company Law Tribunal and the Appellate Tribunal. |

| Micro, Small and Medium Enterprises Development Act, 2006 | Sec 18 of the Act mandates mediation and conciliation when disputes arise. |

| Real Estate (Regulation and Development) Act, 2016 | Section 32(g) provides for the amicable settlement of disputes through an established dispute resolution forum. |

| Commercial Courts Act, 2015 | It provides for mandatory mediation between parties before filing a suit. Ligitation is allowed only if mediation fails. |

| Consumer Protection Act, 2019 | It provides for the resolution of disputes through mediation first before approaching a consumer redressal agency. |

Advantages of ADR

- Faster & cost-effective

- Less adversarial, more amicable

- Reduces burden on courts

Regulatory Bodies in India

Along with Courts & Tribunals, regulators play a vital role in governance. Some popular regulatory bodies are:

| Regulatory Body | Function |

| SEBI (1992) | Regulates securities market, protects investors, prevents insider trading. |

| RBI (1934) | Central bank; controls currency, reserves, banking regulation, foreign exchange. |

| IRDAI (1999) | Regulates insurance sector; protects policyholders. |

| PFRDA (2013) | Regulates pension funds. |

| AMFI | Self-regulatory body for mutual funds, investor awareness. |

| MCA | Regulates corporate sector & company law. |

| NHB | Regulates housing finance institutions. |

Securities and Exchange Board of India (SEBI)

The Securities and Exchange Board of India (SEBI) was established under the SEBI Act, 1992 to prevent malpractices in the capital market and restore people’s confidence in investing. Its main objective is to:

- Protect the interests of investors,

- Prevent frauds and unfair practices, and

- Ensure fair and proper functioning of the securities market.

Functions of SEBI

SEBI’s functions can be grouped into three categories:

- Protective Functions

- Safeguard investors and market participants.

- Prevent insider trading and price rigging.

- Spread investor education and awareness.

- Regulatory Functions

- Ensure smooth functioning of market activities.

- Frame and enforce code of conduct for intermediaries.

- Audit exchanges, register intermediaries (like brokers, investment bankers), levy fees, and impose penalties for misconduct.

- Development Functions

- Promote growth and development of the capital market.

- Train intermediaries, conduct research, and encourage self-regulation.

- Facilitate innovation in the securities market.

Powers of SEBI

- Change laws relating to the functioning of the stock exchange.

- Access records and financial statements of exchanges

- Conduct hearing and give judgments on cases of malpractices in the markets.

- Approve the listing/ delisting of companies from any exchanges.

- Take disciplinary actions like fines and penalties against those involved in malpractice.

- Regulate various intermediaries and middlemen like brokers.

Reserve Bank of India (RBI)

The Reserve Bank of India (RBI) is India’s central bank, established under the RBI Act, 1935. Its primary purpose is to:

- Conduct monetary policy,

- Regulate and supervise the financial sector (banks and non-banking finance companies),

- Maintain price stability, and

- Ensure smooth flow of credit to various sectors of the economy.

Main Functions of RBI

| Title | Explanation |

| Licensing and Branch Authorization | Issues licenses for new banks and authorizes new bank branches. |

| Formulating Prudential Norms | Sets and reviews norms like the Basel framework for safe banking. |

| Regulating Reserves | Ensures banks maintain required reserve ratios. |

| Supervision & Inspection | Audits financial accounts of banks, monitors their stability and stress. |

| Handle Liquidation/Amalgamation | Oversees mergers, reconstruction, or closure of financial companies. |

| Payment & Settlement Systems | Regulates infrastructure for smooth transactions across the economy. |

| Currency Management | Prints, issues, and circulates Indian currency. |

| Banker to the government | Manages public debt, government securities. |

| Manages foreign exchange | Manages foreign exchange under the FEMA Act, 1999. |

| Ensures market stability | Ensures stability in the government securities market (G-Sec) |

Insurance Regulatory and Development Authority of India (IRDAI)

The Insurance Regulatory and Development Authority of India (IRDAI) is an independent statutory body established under the IRDA Act, 1999. Its primary purpose is:

- To protect the interests of insurance policyholders.

- To regulate and develop the insurance industry.

- To issue advisories to insurance companies regarding changes in rules and regulations.

- It monitors charges and rates related to insurance.

Objectives of IRDAI

- To ensure fair treatment and protect the interests of policyholders.

- To regulate insurance companies and ensure the industry’s financial soundness.

- To formulate standards and regulations to avoid ambiguity.

Functions of IRDAI:

a. Granting, renewing, canceling, or modifying registration of insurance companies.

b. Levying charges and fees as per the IRDA Act.

c. Conducting investigations, inspections, audits, etc., of insurance companies and related organizations.

d. Specifying the code of conduct and providing qualification and training to insurance agents and intermediaries.

e. Regulating the insurance premium rates, terms and conditions and other benefits offered by insurers.

f. Provides a grievance redressal forum and protect the interests of the policyholder.

Pension Funds Regulatory and Development Authority (PFRDA)

- Established: Under the PFRDA Act, 2013.

- Nature: Statutory body and sole regulator of the pension industry in India.

- Coverage:

- Initially for government sector employees.

- Later extended to all citizens of India, including NRIs.

Objectives of PFRDA:

- To provide income security to old age people by regulating and developing pension funds.

- To protect the interests of subscribers to pension schemes.

Role in National Pension System (NPS):

- PFRDA manages the National Pension System (NPS).

- Regulates custodians and trustee banks.

- Central Record Keeping Agencies (CRAs) under PFRDA handle:

- Record keeping

- Accounting

- Customer service to pension subscribers

Functions of PFRDA:

(i) Conducting enquiries and investigations on intermediaries and participants.

(ii) Increasing public awareness & training intermediaries about retirement savings, pension schemes, etc.

(iii) Settling disputes between intermediaries and pension subscribers.

(iv) Registering and regulating intermediaries.

(v) Protecting the interest of pension fund users.

(vi) Issuing guidelines for investment of pension funds.

(vii) Formulating codes of conduct, standards of practice, terms, and norms for the pension industry.

Association of Mutual Funds in India (AMFI)

It was established in 1995 as a non-profit, self-regulatory organization. Its primary purpose is development of the mutual fund industry by:

- Improving professional and ethical standards.

- Making mutual funds accessible and transparent to the public.

- Spreading awareness and vital information about mutual funds among Indian investors.

Regulatory Role:

- AMFI is the regulatory body for the mutual fund sector in India.

- Functions under the Securities and Exchange Board of India (SEBI), Ministry of Finance, Government of India.

- Most mutual fund firms in India are members of AMFI.

Functions of AMFI:

- Ensures smooth functioning of the mutual fund industry.

- Implements high ethical standards to protect both fund houses and investors.

- Most Asset Management Companies (AMCs), brokers, fund houses, and intermediaries in India are AMFI members.

- Registered AMCs must follow the Code of Ethics set by AMFI, which include:

- Integrity

- Due diligence

- Disclosures

- Professional selling and investment practice.

- Updates the Net Asset Value of funds on a daily basis on its website

- Streamlines the process of searching mutual fund distributors.

Ministry of Corporate Affairs (MCA)

It is a ministry within the Government of India. It is concerned with:

- Administration of Companies Act, 1956, Companies Act, 2013, and related legislations.

- Framing rules and regulations for smooth functioning of the corporate sector.

Objective:

- Protect the interests of all stakeholders.

- Maintain a competitive and fair environment.

- Facilitate the growth and development of companies.

Examples: Registrar of Companies (ROC) works under MCA. It has the authority to register companies and ensure compliance with law. Issuance of securities by companies also falls under MCA’s purview.

National Housing Bank (NHB)

- Nature: Apex regulatory body for housing finance companies in India.

- Jurisdiction: Under Ministry of Finance, Government of India.

- Established: 9 July 1988 under the National Housing Bank Act, 1987.

- Functions:

- Acts as a principal agency to promote housing finance institutions at local and regional levels.

- Provides financial and other support to such institutions.

- Handles matters connected or incidental to housing finance.

Qusetion and Answers for Revision

Click the question to view the answers.

1. Which Article establishes the Supreme Court of India?

Ans. Article 124

2. Which Article empowers the Supreme Court with Writ Jurisdiction?

Ans. Article 32

3. Which Article empowers the High Courts with Writ Jurisdiction?

Ans. Article 226

4. Which Article deals with Original Jurisdiction of Supreme Court?

Ans. Article 131

5. Which Article gives Advisory Jurisdiction to the Supreme Court?

Ans. Article 143

6. Which Article empowers Supreme Court to punish for Contempt?

Ans. Article 129

7. Which Article gives High Courts power of Superintendence?

Ans. Article 227

8. Which Article gives High Courts power of Transfer?

Ans. Article 228

9. Which Article allows Supreme Court to review its judgments?

Ans. Article 137

10. Which Articles cover Subordinate Courts?

Ans. Articles 233–237

11. India follows which type of judicial system?

Ans. Single Integrated

12. Who appoints Judges of the Supreme Court?

Ans. President

13. Which is the highest Civil Court at District level?

Ans. District Court

14. Which courts handle serious criminal matters?

Ans. Sessions Court

15. Which court deals with tenancy and rent disputes in metros?

Ans. Small Causes

16. Which Article introduced Tribunals in the Constitution?

Ans. 323A / 323B

17. What is the key feature of Tribunals?

Ans. They are Quasi-judicial

18. Which Section of CPC, 1908 provides legal basis for ADR?

Ans. Sec.89

19. Which Acts governs Alternative Dispute Resolutions in India?

Ans.Arbitration & Conciliation Act 1996; and The Legal Services Authority Act, 1987.

20. Which Act gave statutory status to Lok Adalats?

Ans. The Legal Services Authority Act, 1987.

22. The neutral decision-maker in Arbitration is called?

Ans. Arbitrator

23. The neutral facilitator in Mediation is called?

Ans. Mediator

24. The neutral helper suggesting solutions in Conciliation is called?

Ans. Conciliator

25. SEBI was established under which Act?

Ans. SEBI Act, 1992

26. Which Act established the RBI?

Ans. RBI Act, 1935

27. IRDAI was established under which Act?

Ans. IRDA Act, 1999

28. PFRDA was established under which Act?

Ans. PFRDA Act, 2013

29. Which organization regulates Mutual Funds in India?

Ans. AMFI

30. Which Ministry regulates corporate affairs?

Ans. MCA

31. Which body regulates Housing Finance Institutions?

Ans. NHB

32. What is the primary objective of SEBI?

Ans. Investor Protection

33. What is the primary objective of RBI?

Ans. Monetary Stability

34. What is the primary objective of IRDAI?

Ans. Policyholder Protection

35. What is the primary objective of PFRDA?

Ans. Pension Security

Fill in the blanks

Click the questions to reveal the answers.

1. The Supreme Court of India was established under Article ____.

Ans. 124

2. Article ____ empowers the Supreme Court to enforce Fundamental Rights.

Ans. 32

3. The High Courts’ writ jurisdiction is given under Article ____.

Ans. 226

4. The power of Superintendence of High Courts is under Article ____.

Ans. 227

5. The power of Transfer of cases to High Courts is under Article ____.

Ans. 228

6. The highest Civil Court at the district level is the ____ Court.

Ans. District

7. Serious criminal matters are tried by the Court of ____.

Ans. Session

8. ADR in India is provided under Section ____ of CPC, 1908.

Ans. 89

9. The regulatory body for securities markets in India is ____.

Ans. SEBI

10. The Insurance sector in India is regulated by ____.

Ans. IRDAI

11. Pension funds in India are regulated by ____.

Ans. PFRDA

12. The central bank of India is ____.

Ans. RBI

13. The apex housing finance regulator in India is ____.

Ans. NHB

True or False

Click the questions to reveal the answers.

1. India follows a dual judicial system, separate for Centre and States.

Ans. False

2. Article 131 provides the Original Jurisdiction of the Supreme Court.

Ans. True

3. Article 143 deals with the President’s power to seek Supreme Court’s advice.

Ans. True

4. The Supreme Court cannot punish for Contempt of Court.

Ans. False

5. High Courts have broader writ jurisdiction than the Supreme Court.

Ans. True

6. The Court of Small Causes handles serious criminal matters.

Ans. False

7. Arbitration awards are non-binding in nature.

Ans. False

8. The decision of a Lok Adalat is final and binding.

Ans. True

9. SEBI was established under the Securities and Exchange Board of India Act, 1992.

Ans. True

10. RBI was established under the Banking Regulation Act, 1949.

Ans. False

11. IRDAI was created to regulate and promote the insurance sector.

Ans. True

12. PFRDA regulates the National Pension System in India.

Ans. True

13. AMFI is a statutory body established by Parliament.

Ans. False

14. MCA regulates company law and corporate governance in India.

Ans. True

15. NHB regulates the securities market in India.

Ans. False

Conclusion

That brings us to the end of lesson 1.3. There’s quite a bit of info packed into this lesson. Make sure you are familiar with the various courts, their structures, the different regulatory bodies and thier primary functions. Once you are thorough with lesson 1.3, you can move on to Lesson 1.4, which deals with primary and subordinate legislation.

You can also test your knowledge and understanding of this lesson by taking advantage of our MCQ Practice Questions (MCQs).

Let us know if you have any questions or doubts in the comments section.

Leave a Reply