Part-A Multiple Choice Questions

| 1. Every able bodied person who is willing to work at the prevailing wage rate is employed called as ………. | |

| (a) Full employment | |

| (b) Under employment | |

| (c) Unemployment | |

| (d) Employment opportunity | |

| 2. Structural unemployment is a feature in a ……….. | |

| (a) Static society | |

| (b) Socialist society | |

| (c) Dynamic society | |

| (d) Mixed economy | |

| 3. In disguised unemployment, the marginal productivity of labour is ….. | |

| (a) Zero | |

| (b) One | |

| (c) Two | |

| (d) Positive | |

| 4. The main concention of the Classical Economic Theory is …….. | |

| (a) Under employment | |

| (b) Economy is always in the state of equilibrium | |

| (c) Demand creates its supply | |

| (d) Imperfect competition | |

| 5. J.B. Say is a ……………………. | |

| (a) Neo Classical Economist | |

| (b) Classical Economist | |

| (c) Modern Economist | |

| (d) New Economist | |

| 6. According to Keynes, which type of unemployment prevails in capitalist economy ? | |

| (a) Full employment | |

| (b) Voluntary unemployment | |

| (c) Involuntary unemployment | |

| (d) Under employment | |

| 7. The core of the classical theory of employment is ………… | |

| (a) Law of Diminishing Return | |

| (b) Law of Demand | |

| (c) Law of Markets | |

| (d) Law of Consumption | |

| 8. Keynes attributes unemployment to ………….. | |

| (a) A lack of effective supply | |

| (b) A lock of effective demand | |

| (c) A lack of both | |

| (d) None of the above | |

| 9. ………. Flexibility brings equality between saving and investment. | |

| (a) Demand | |

| (b) Supply | |

| (c) Capital | |

| d) Interest | |

| 10. …………… theory is a turning point in the development of modern economic theory. | |

| (a) Keynes’ | |

| (b) Say’s | |

| (c) Classical | |

| (d) Employment | |

| 11. The basic concept used in Keynes Theory of Employment and Income is……………. | |

| (a) Aggregate demand | |

| (b)Aggregate supply | |

| (c) Effective demand | |

| (d) Marginal Propensity Consume | |

| 12. The component of aggregate demand is …………. | |

| (a) Personal demand | |

| (b) Government expenditure | |

| (c) Only export | |

| (d) Only import | |

| 13. Aggregate supply is equal to …………. | |

| (a) C + I + G | |

| (b) C + S + G + (x-m) | |

| (c) C + S + T + (x-m) | |

| (d) C + S + T + Rf | |

| 14. Keynes theory pursues to replace laissez faire by ………… | |

| (a) No government intervention | |

| (b) Maximum intervention | |

| (c) State intervention in certain situation | |

| (d) Private sector intervention | |

| 15. In Keynes theory of employment and income, ………….. is the basic cause of economic depression. | |

| (a) Less production | |

| (b) More demand | |

| (c) Inelastic supply | |

| (d) Less aggregate demand in relation to productive capacity. | |

| 16. Classical theory advocates …… | |

| (a) Balanced budget | |

| (b) Unbalanced budget | |

| (c) Surplus budget | |

| (d) Deficit budget | |

| 17. Keynes theory emphasized on …… equilibrium. | |

| (a) Very short run | |

| (b) Short run | |

| (c) Very long run | |

| (d) Long run | |

| 18. According to classical theory, rate of interest is a reward for …… | |

| (a) Investment | |

| (b) Demand | |

| (c) Capital | |

| (d) Saving | |

| 19. In Keynes theory , the demand for and supply of money are determined by …. | |

| (a) Rate of interest | |

| (b) Effective demand | |

| (c) Aggregate demand | |

| (d) Aggregate supply | |

| 20. Say’s law stressed the operation of …………. in the economy. | |

| (a) Induced price mechanism | |

| (b) Automatic price mechanism | |

| (c) Induced demand | |

| (d) Induced investment |

Part-B Answer the following questions in one or two sentences

21. What is consumption function?

Answer: The consumption function refers to income consumption relationship. It is a “functional relationship between two aggregates viz., total consumption and gross national income.” The relationship is represented as C= f (Y) where, C = Consumption; Y = Income; f = Function.

22. What do you mean by propensity to consume?

Answer: Propensity to consume refers to income consumption relationship. It is a “functional relationship between two aggregates viz., total consumption and gross national income.”

23. Define average propensity to consume (APC).

Answer: The average propensity to consume is the ratio of consumption expenditure to any particular level of income.” It is expressed as APC=C/Y where, C= Consumption; Y = Income

24. Define marginal propensity to consume (MPC).

Answer: The marginal propensity to consume is defined as the ratio of the change in the consumption to the change in income. It is expressed as MPC = ΔC/ΔY where, ΔC= Change in Consumption; ΔY = Change in Income; MPC is positive but less than unity 0 < ΔC ΔY <1

25. What do you mean by propensity to save?

Answer: The proportion of total income or an increase in income that consumers save rather than spend on goods and services is known as the propensity to save.

26. Define average propensity to save (APS).

Answer: The average propensity to save is the ratio of saving to income. APS is the quotient obtained by dividing the total saving by the total income. It is the ratio of total savings to total income. It is expressed as APS = S/Y where S= Saving; Y=Income

27. Define Marginal Propensity to Save (MPS).

Answer: Marginal Propensity to Save is the ratio of change in saving to a change in income. MPS is obtained by dividing change in savings by change in income. It is expressed as MPS = ΔS/ΔY where ΔS = Change in Saving; ΔY= Change in Income

Since MPC+MPS=1 MPS=1-MPC and MPC = 1 – MPS

28. Define Multiplier.

Answer: The multiplier is defined as the ratio of the change in national income to change in investment. If ΔI stands for increase in investment and ΔY stands for resultant increase in income, the multiplier K =ΔY/ΔI. Since ΔY results from ΔI, the multiplier is called investment multiplier.

29. Define Accelerator.

Answer: Accelerator is the numerical value of the relation between an increase in consumption and the resulting increase in investment. Accelerator (β)= ΔC/ ΔI where ΔI = Change in investment outlays; ΔC = Change in consumption demand.

Part C Answer the following questions in one paragraph

30. State the propositions of Keynes’s Psychological Law of Consumption

Answer: Keynes’s Psychological Law of Consumption has three propositions:

- When income increases, consumption expenditure also increases but by a smaller amount. The reason is that as income increases, our wants are satisfied side by side, so that the need to spend more on consumer goods diminishes.

- The increased income will be divided in some proportion between consumption expenditure and saving. When the whole of increased income is not spent on consumption, the remaining is saved.

- Increase in income always leads to an increase in both consumption and saving. This means that increased income is unlikely to lead to fall in either consumption or saving.

31. Differentiate autonomous and induced investment.

Answer:

| Autonomous Investment | Induced Investment |

| The investment which does not change with the change in income is called autonomous investment. | The investment which responds to a change in income is called induced investment. |

| It is independent of level of income. | It is dependent of level of income. |

| It is income-inelastic. | It is income elastic. |

| It is determined by consideration of social welfare. | It is determined by consideration of profit. |

| It is related to the government sector. | It is related to the private sector. |

| The Autonomous investment curve remains parallel to X axis. | The Induced investment curve slopes upward or downward. |

32. Explain any three subjective and objective factors influencing the consumption function.

Answer: J.M Keynes has divided factors influencing the consumption function into two namely: Subjective factors and Objective factors

Subjective Factors: Subjective factors are the internal factors related to psychological feelings. 3 subjective factors include:

- The motive of precaution: To build up a reserve against unforeseen contingencies. Eg. accidents, sickness

- The motive of foresight: The desire to provide for anticipated future needs. Eg. Old age

- The motive of calculation: The desire to enjoy interest and appreciation.

Objective Factors: Objective factors are the external factors which are real and measurable. 3 objective factors include:

- Income Distribution: If there is large disparity between rich and poor, the consumption is low because the rich people have low propensity to consume and high propensity to save.

- Price level: When the price falls, real income goes up; people will consume more and propensity to save of the society increases.

- Wage level: There is a positive relationship between wage and consumption. Consumption expenditure increases with the rise in wages.

33. Mention the differences between accelerator and multiplier effect.

Answer:

| Accelerator Effect | Multiplier Effect |

| Accelerator is the numerical value of the relation between an increase in consumption and the resulting increase in investment. | The multiplier is defined as the ratio of the change in national income to change in investment. |

| There is a change in demand | There is a change in investment |

| Accelerator (β)= ΔC/ ΔI | K =ΔY/ΔI |

| It is also known as The Accelerator Coefficient | It is also known as Investment Multiplier |

34. State the concept of super multiplier.

Answer: In order to measure the total effect of initial investment on income, Hicks has combined the k and β mathematically and given it the name of the Super Multiplier.

The super multiplier is worked out by combining both induced consumption and induced investment. The super multiplier is greater than simple multiplier which includes only autonomous investment and no induced investment, while super multiplier includes induced investment.

35. Specify the limitations of the multiplier.

Answer: The multiplier assumes that those who earn income are likely to spend a proportion of their additional income on consumption. But in practice, people tend to spend their additional income on other items. Such expenses are known as leakages.

Payment towards past debts: If a portion of the additional income is used for repayment of old loan, the MPC is reduced and as a result the value of multiplier is cut.

Purchase of existing wealth: If income is used in purchase of existing wealth such as land and building, money is circulated among people and never enters into the consumption stream. As a result the value of multiplier is affected.

Import of goods and services: Income spent on imports of goods or services has little chance to return as income. Thus imports reduce the value of multiplier.

Non availability of consumer goods: The multiplier theory assumes instantaneous supply of consumer goods following demand. But there is often a time lag. During this gap inflation is likely to rise. This reduces the consumption expenditure and thereby multiplier value.

Full employment situation: Under conditions of full employment, resources are almost fully employed. So, additional investment will lead to inflation only, rather than generation of additional real income.

Part D – Answer the following questions in a page

36. Explain Keynes psychological law of consumption function with diagram.

Answer: Keynes propounded the fundamental Psychological Law of Consumption. The law implies that there is a tendency on the part of the people to spend on consumption less than the full increment of income.

Assumptions: Keynes’s Law is based on the following assumptions:

1. Ceteris paribus (constant extraneous variables):

The other variables such as income distribution, tastes, habits, social customs, price movements, population growth, etc. do not change and consumption depends on income alone.

2. Existence of Normal Conditions:

The law holds good under normal conditions. If, however, the economy is faced with abnormal and extraordinary circumstances like war, revolution or hyperinflation, the law will not operate. People may spend the whole of increased income on consumption.

3. Existence of a Laissez-faire Capitalist Economy:

The law operates in a rich capitalist economy where there is no government intervention. People should be free to spend increased income. In the case of regulation of private enterprise by the State, the law breaks down.

Propositions of the Law: This law has three propositions:

(1) When income increases, consumption expenditure also increases but by a smaller amount. The reason is that as income increases, our wants are satisfied side by side, so that the need to spend more on consumer goods diminishes. So, the consumption expenditure increases with increase in income but less than proportionately.

(2) The increased income will be divided in some proportion between consumption expenditure and saving. When the whole of increased income is not spent on consumption, the remaining is saved. In this way, consumption and saving move together.

(3) Increase in income always leads to an increase in both consumption and saving. This means that increased income is unlikely to lead to fall in either consumption or saving.

Thus with increased income both consumption and saving increase.

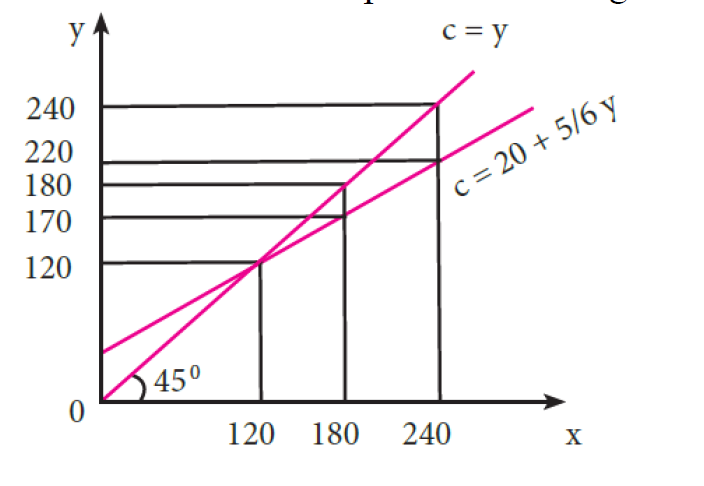

| Income Y | Consumption C | Savings S = Y – C |

| 120 | 120 | 0 |

| 180 | 170 | 10 |

| 240 | 220 | 20 |

Proposition (1):

Income increases by ₹ 60 crores and the increase in consumption is by ₹ 50 crores.

Proposition (2):

The increased income of ₹ 60 crores in each case is divided in some proportion between consumption and saving. (i.e., ₹ 50crores and ₹ 10 crores).

Proposition (3):

As income increases consumption as well as saving increase. Neither consumption nor saving has fallen.

Here, income is measured horizontally and consumption and saving are measured on the vertical axis. С is the consumption function curve and 45° line represents income consumption equality.

Proposition (1):

When income increases from 120 to 180 consumption also increases from 120 to 170 but the increase in consumption is less than the increase in income, 10 is saved.

Proposition (2):

When income increases to 180 and 240, it is divided in some proportion between consumption by 170 and 220 and saving by 10 and 20 respectively.

Proposition (3):

Increases in income to 180 and 240 lead to increased consumption 170 and 220 and increased saving 20 and 10 than before. This is clear from the widening area below the С curve and the saving gap between 45° line and С curve.

37. Briefly explain the subjective and objective factors of consumption function?

J.M Keynes has divided factors influencing the consumption function into two namely: Subjective factors and Objective factors.

Subjective Factors

Subjective factors are the internal factors related to psychological feelings. The major subjective factors influencing

consumption function are given below.

1. The motive of precaution: To build up a reserve against unforeseen contingencies. Eg. Accidents, sickness

2. The motive of foresight: The desire to provide for anticipated future needs. Eg. Old age

3. The motive of calculation: The desire to enjoy interest and appreciation.

4. The motive of improvement: The desire to enjoy for improving standard of living.

5. The motive of financial independence.

6. The motive of enterprise.

7. The motive of pride.

8. The motive of avarice.

The Government, institutions and business corporations and firms may also consume mainly because of the following four motives:

1. The motive of enterprise: The desire to obtain resources to carry out further capital investment without incurring debt.

2. The motive of liquidity: The desire to secure liquid resources to meet emergencies, and difficulties.

3. The motive of improvement: The desire to secure a rising income and to demonstrate successful management.

4. The motive of financial prudence: The desire to ensure adequate financial provision against depreciation and obsolescence and to discharge debt.

According to Keynes, the subjective factors do not change in the short run and hence consumption function remains stable in the short period.

Objective Factors

Objective factors are the external factors which are real and measurable. These factors can be easily changed in the long run. Major objective factors influencing consumption function are:

1) Income Distribution

If there is large disparity between rich and poor, the consumption is low because the rich people have low propensity to consume and high propensity to save. The community with more equal distribution of income tends to have high propensity to consume.

2) Price level

When the price falls, real income goes up; people will consume more and propensity to save of the society increases.

3) Wage level

There is a positive relationship between wage and consumption. Consumption expenditure increases with the rise in wages. Similar is the effect with regard to windfall gains.

4) Interest rate

Higher rate of interest will encourage people to save more money and reduces consumption.

5) Fiscal Policy

When government reduces the tax the disposable income rises and the propensity to consume increases. The progressive tax system increases the propensity to consume by altering the income distribution in favour of the poor.

6) Consumer credit

The availability of consumer credit at easy installments will encourage households to buy consumer durables like automobiles, fridge, computer. This pushes up consumption.

7) Demographic factors

The larger the size of the family, the greater is the consumption. Besides size of family, stage in family life cycle, place of residence and occupation affect the consumption function.

8) Duesenberry hypothesis

Duesenberry has made two observations regarding the factors affecting consumption. a) The consumption expenditure depends not only on current income but also past income and standard of living. As individuals are accustomed to a particular standard of living, they continue to spend the same amount on consumption even though the current income is reduced.

b) Consumption is influenced by demonstration effect. The consumption standards of low income groups are influenced by the consumption standards of high income groups. This results in spending beyond their income level.

9) Windfall Gains or losses

Unexpected changes in the stock market leading to gains or losses tend to shift the consumption function upward or downward.

38. Illustrate the working of Multiplier.

Answer: The multiplier is defined as the ratio of the change in national income to change in investment. If ΔI stands for increase in investment and ΔY stands for resultant increase in income, the multiplier K =ΔY/ΔI. Since ΔY results from ΔI, the multiplier is called investment multiplier.

Working of Multiplier

Suppose the Government undertakes investment expenditure equal to Rs. 100 crore on some public works, by way of wages, price of materials etc. Thus income of labourers and suppliers of materials increases by Rs.100 crore. Suppose the MPC is 0.8 that is 80 %. A sum of Rs. 80 crores is spent on consumption (A sum of Rs. 20 Crores is saved). As a result, suppliers of goods get an income of Rs. 80 crores. They in turn spend Rs. 64 crores (80% of Rs. 80 cr).

In this manner consumption expenditure and increase in income act in a chain like manner.

The final result is ΔY = 100+100×4/5+100 ×[4/5]2+100×[4/5]3 or,

ΔY = 100 + 100 x 0.8 + 100 x (0.8)2 + 100 x (0.8)3

= 100 + 80 + 64 + 51.2…

= 500

that is 100×1/1-4/5

100×1/1/5

100×5 = Rs. 500 crores

For instance if C = 100 + 0.8Y, I = 100,

Then Y = 100 + 0.8Y + 100

0.2Y = 200

Y = 200/0.2 = 1000→Point B

If I is increased to 110, then

0.2Y =210

Y = 210/0.2 = 1050→Point D

For Rs. 10 increase in I, Y has increased by Rs.50.

This is due to multiplier effect. At point A, Y = C = 500

C = 100 + 0.8 (500) = 500; S=0

At point B, Y = 1000

C = 100 + 0.8 (1000) = 900; S = 100 = I

At point D, Y = 1050

C = 100 + 0.8 (1050) = 940; S = 110 = I

When I is increased by 10, Y increases by 50.

This is multiplier effect (K = 5)

K = 1 /0.2 = 5

39. Explain the operation of the Accelerator.

Answer: Accelerator is the numerical value of the relation between an increase in consumption and the resulting increase in investment.

Accelerator (β)= ΔI/ ΔC

ΔI = Change in investment outlays

ΔC = Change in consumption demand

The accelerator expresses the ratio of the net change in investment to change in consumption.

Operation of the Acceleration Principle

Let us consider a simple example.

The operation of the accelerator may be illustrated as follows.

Let us suppose that in order to produce 1000 consumer goods, 100 machines are required. Also suppose that working life of a machine is 10 years. This means that every year 10 machines have to be replaced in order to maintain the constant flow of 1000 consumer goods. This might be called replacement demand.

Suppose that demand for consumer goods rises by 10 percent. (ie from 1000 to 1100). This results in increase in demand for 10 more machines. So the total demand for machines is 20. (10 for replacement and 10 for meeting increased demand). It may be noted here a 10 percent increase in demand for consumer goods causes a 100 percent increase in demand for machines (from 10 to 20). So we can conclude even a mild change in demand for consumer goods will lead to wide change in investment.

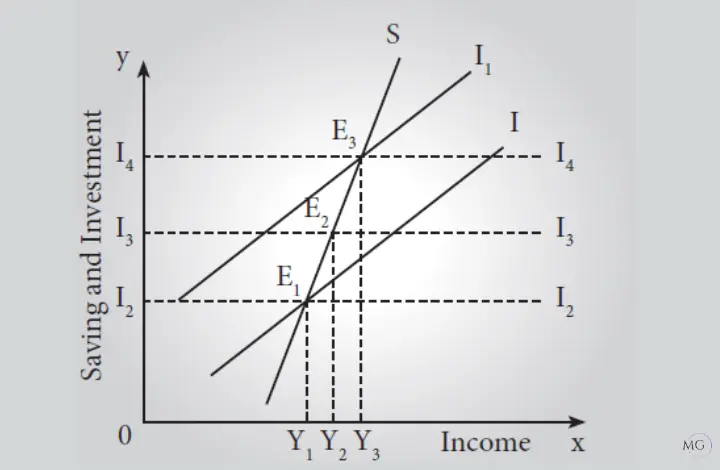

SS is the saving curve. II is the investment curve. At point E1, the economy is in equilibrium with OY1 income. Saving and Investment are equal at OI2. Now, investment is increased from

OI2 to OI4. This increases income from OY1 to OY3, the equilibrium point being E3. If the increase in investment by I2 I4 is purely exogenous, then the increase in income by Y1 Y3 would have been due to the multiplier effect. But in this diagram it is assumed that exogenous investment is only by I2 I3 and induced investment is by I3 I4. Therefore, increase in income by Y1 Y2 is due to the multiplier effect and the increase in income by Y2 Y3 is due to the accelerator effect.

40. What are the differences between MEC and MEI

Answer:

| Marginal Efficiency of Capital(MEC) | Marginal Efficiency of Investment(MEI) |

| It is based on a given supply price for capital. | It is based on the induced change in the price due to change in the demand for capital. |

| It represents the rate of return on all successive units of capital without regard to existing capital. | It shows the rate of return on just those units of capital over and above the existing capital stock. |

| The capital stock is taken on the X axis of diagram. | The amount of investment is taken on the X – axis of diagram. |

| It is a “stock” concept. | It is a “flow” concept. |

| It determines the optimum capital stock in an economy at each level of interest rate. | It determines the net investment of the economy at each interest rate given the capital stock. |

Leave a Reply