Dear students,

Before you get started with chapter 4, Goodwill in Partnership Accounts, do a quick revision of all the important formulas. Also be thorough with the format of the different accounts. Then, when you start working out the problems, you will do it with confidence and also do it easily. Here are the Important Formulas and Formats in Goodwill in Partnership Accounts that you must remember.

Methods of Valuation of Goodwill

Calculation of Adjusted Profit

| Adjusted profit = | Actual profit |

| + Past expenses not required in the future | |

| – Past revenues not likely to be earned in the future | |

| + Additional income expected in the future | |

| – Additional expenses expected to be paid in the future |

Average profit method:

(a) Simple average profit method

Goodwill = Average profit × Number of years of purchase

![]()

(b) Weighted average profit method

Goodwill = Weighted average profit × Number of years of purchase

![]()

Super profit method:

Normal profit = Capital employed × Normal rate of return

Capital employed = Fixed assets + Current assets – Current liabilities

Normal rate of return = It is the rate at which profit is earned by similar business entities in the industry under normal circumstances.

Super Profit = Average profit – Normal profit

(a) Purchase of super profit method

Goodwill = Super profit × Number of years of purchase

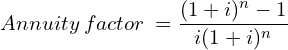

(b) Annuity method

Goodwill = Super profit × Present value annuity factor

where i = interest rate; n = estimated number of years.

(c) Capitalisation of super profit method

![]()

Capitalisation method

Goodwill = Total capitalised value of the business – Actual capital employed

![]()

Actual capital employed = Fixed assets (excluding goodwill) + Current assets – Current liabilities

Click here to check the text book solutions in Chapter 4: Goodwill in Partnership accounts.

Leave a Reply