Dear Samacheer Kalvi students, here are the Chapter 8 – Securities Exchange Board Of India – Class 12 Text Book Solutions (Commerce), for your reference and study.

I. Choose the Correct Answers:

| 1. Securities Exchange Board of India was first established in the year ____ | |

| a) 1988 | |

| b) 1992 | |

| c) 1995 | |

| d) 1998 | |

| 2. The headquarters of SEBI is _______ | |

| a) Calcutta | |

| b) Bombay | |

| c) Chennai | |

| d) Delhi | |

| 3. Registering and controlling the functioning of collective investment schemes as _______ | |

| a) Mutual Funds | |

| b) Listing | |

| c) Rematerialisation | |

| d) Dematerialization | |

| 4. SEBI is empowered by the Finance ministry to nominate ______ members on the Governing body of every stock exchange. | |

| a) 5 | |

| b) 3 | |

| c) 6 | |

| d) 7 | |

| 5. Trading in dematerialized shares commenced on the NSE in ________ | |

| a) January 1996 | |

| b) June 1998 | |

| c) December 1996 | |

| d) December 1998 |

II. Very Short Answer Questions:

1. Write a short notes on SEBI.

Answer: Securities and exchange Board of India (SEBI) was first established in the year 1988 as a non-statutory body for regulating the securities market. It was made as an autonomous body by The Government of India on 12 May 1992 and given statutory powers with SEBI Act 1992 being passed by the Indian Parliament. SEBI has its headquarters in Mumbai.

2. Write any two objectives of SEBI.

Answer: Two objectives of SEBI are:

1. Regulation of Stock Exchanges

The first objective of SEBI is to regulate stock exchanges so that efficient services may be provided to all the parties operating there.

2. Control over Brokers

It is important to check the activities of brokers and other middlemen in order to control the capital market. To regulate their activities, it was necessary to establish the SEBI.

3. Mention the headquarters of SEBI.

Answer: SEBI has its headquarters at the business district of BandraKurla Complex in Mumbai, and has Northern, Eastern, Southern and Western Regional Offices in New Delhi, Kolkata, Chennai and Ahmedabad respectively.

4. What are the various ID proofs?

Answer: Various ID proofs include PAN card, voter’s ID, passport, driver’s license, bank attestation, IT returns, electricity bill, telephone bill, ID cards with applicant’s photo issued by the central or state government and its departments, statutory or regulatory authorities, public sector undertakings (PSUs), scheduled commercial banks, public financial institutions, colleges affiliated to universities, or professional bodies such as ICAI, ICWAI, ICSI, bar council etc.

III. Short Answer Questions:

1. What is meant by Dematerialization?

Answer: Dematerialization is the process by which physical share certificates of an investor are taken back by the company and destroyed. Then an equivalent number of securities in the electronic form are credited to the investors account with his Depository Participant.

2. What are the documents required for a Demat account?

Answer: You need to submit proof of identity and address along with a passport size photograph and the account opening form. Only photocopies of the documents are required for submission, but originals are also required for verification.

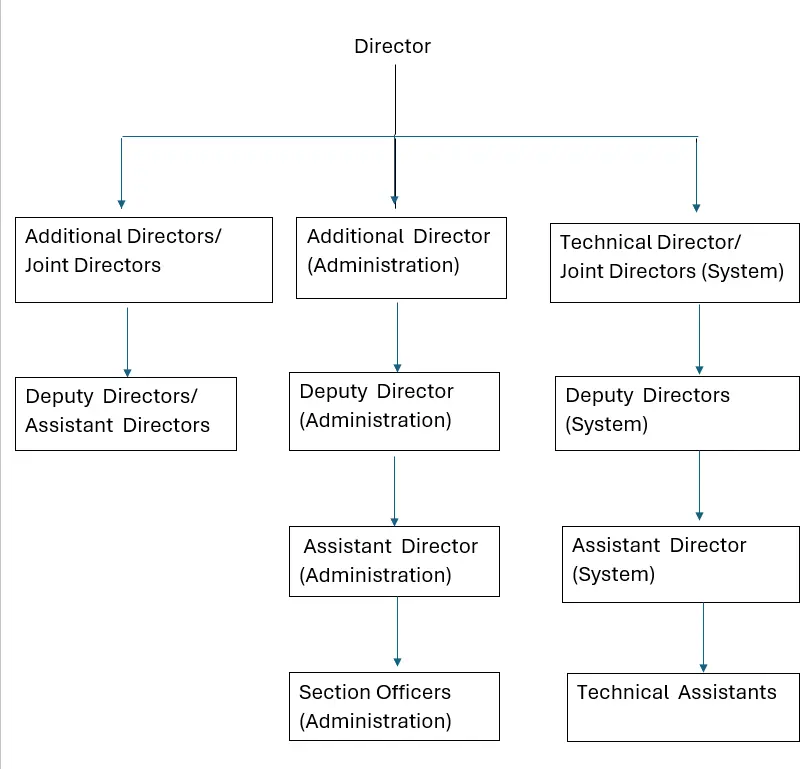

3. Draw the organization structure of SEBI.

Answer: Organization Structure of SEBI

IV. Long Answer Questions:

1. What are the functions of SEBI? (any 5)

Answer: The functions of SEBI are:

i. Safeguarding the interests of investors by means of adequate education and guidance. SEBI makes rules and regulation that must be followed by the financial intermediaries like portfolio exchanges, underwriters and merchant bankers, etc. It takes care of the complaints received from investors . It also issues notices and booklets for information, assistance and protection of small investors.

ii. Regulating and controlling the business on stock markets. Registration of brokers and sub-brokers is made mandatory and they have to abide by certain regulations and rules.

iii. SEBI conducts inspection and inquiries of stock exchanges, intermediaries and self-regulating organizations and takes appropriate measures wherever required. This function is carried out for organized working of stock exchanges and intermediaries.

iv. Barring insider trading in securities.

v. Prohibiting deceptive and unfair methods used by financial intermediaries operating in securities markets.

2. Explain the powers of SEBI. (any 5)

Answer: The powers of SEBI are:

1. Powers Relating to Stock Exchanges & Intermediaries

SEBI has wide powers regarding the stock exchanges and intermediaries dealing in securities. It can ask them for information regarding their business transactions for inspection or scrutiny and other purpose.

2. Power to Impose Monetary Penalties

SEBI has the power to impose monetary penalties on capital market intermediaries and other participants for a range of violations. It can even impose suspension of their registration for a short period.

3. Power to Initiate Actions in Functions Assigned

SEBI has a power to initiate actions in regard to functions assigned. For example, it can issue guidelines to different intermediaries or can introduce specific rules for the protection of interests of investors.

4. Power to Regulate Insider Trading

SEBI has power to regulate insider trading or can regulate the functions of merchant bankers.

5. Powers Under Securities Contracts Act

For effective regulation of stock exchange, the Ministry of Finance has delegated several of its powers under the Securities Contracts (Regulations) Act to SEBI. SEBI is also empowered by the Finance Ministry to nominate three members on the Governing Body of every stock exchange.

If you have any doubts on this topic, please let us know in the comments section.

Leave a Reply